氧化钙粉MORE+

氧化钙粉就是我们常说的生石灰粉,是一种无机碱性腐蚀物品,产品在与水发生反应...![]()

氧化钙粉

氧化钙MORE+

氧化钙厂家为您介绍:它是一种无机化合物,化学式是CaO,俗名生石灰。物理性...![]()

氧化钙

石灰粉MORE+

石灰粉是以碳酸钙为主要成分的白色粉末状物质。应用范围非常广泛,常见的是用于...![]()

石灰粉

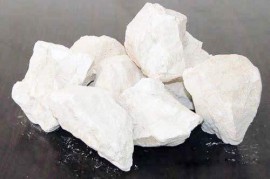

重质碳酸钙MORE+

重质碳酸钙,简称重钙,是由天然碳酸盐矿物如方解石、大理石、石灰石磨碎而成。是...![]()

重质碳酸钙

轻质碳酸钙MORE+

轻质碳酸钙(Light Calcium Carbonate)又称沉淀碳...![]()

轻质碳酸钙

碳酸钙MORE+

碳酸钙是一种无机化合物,化学式为CaCO?,俗称灰石、石灰石...![]()

碳酸钙

生石灰MORE+

生石灰,又称烧石灰,主要成分为氧化钙(化学式:CaO,又称云石),通常制法...![]()

生石灰

熟石灰MORE+

熟石灰一般指氢氧化钙,氢氧化钙(calcium hydroxide)是一种...![]()

熟石灰

关于我们 以信誉求发展,以管理求效益

金彩汇

Zibo Junhai Calcium Industry Co., Ltd.经验丰富

Experience技术先进

advanced种类齐全

complete新闻聚焦 以诚信务实的精神开拓市场

公司始终坚持以质量求生存,以科技求进步......

公司始终坚持以质量求生存,以科技求进步,以信誉求发展,以管理求效益,以诚信务实的精神、追求意识开拓市场:以创新的管理理念、灵活的销售方式、完善的售后服务体制竭诚服务于社会各界:公司本着“加强质量控制、严格检测手段、坚持技术进步、制造产品、提供满意服务”的企业宗旨,以全新的服务模式,的产品质量服务于广大用户。四大优势 以完善的售后服务于社会各界

多年行业经验

Years of industry experience

技术力量雄厚

Strong technical force

严控产品品质

Strictly control quality

售后服务完善

Perfect after-sales service氧化钙厂家:公司本着“加强质量控制、严格检测手段、坚持技术进步、制造产品、提供满意服务”的企业宗旨,

以全新的服务模式,的产品质量服务于广大用户。